Standardised Base Rate, Base Rate & Base Financing Rate

What is Standardised Base Rate (SBR)?

Standardised Base Rate (SBR) is in accordance with the new reference rate framework introduced by Bank Negara Malaysia and it replaces the Base Rate (BR) as the pricing for retail financing effective 1 August 2022. Under this new framework, banks will use the Overnight Policy Rate (OPR) determined by the Monetary Policy Committee (MPC) of Bank Negara Malaysia as its benchmark to quote their base rate.

What would trigger a change in the Standardised Base Rate?

The SBR will be adjusted when there are changes in Overnight Policy Rate (OPR).

What is Base Rate (BR)?

Base Rate (BR) is in accordance with the new reference rate framework introduced by Bank Negara Malaysia effective 2 January 2015. Under this framework, banks will use funding costs and the Statutory Reserve Requirement (SRR) cost imposed by Bank Negara Malaysia as the benchmark to quote their base rate. MBSB Bank’s BR is computed based on its average cost plus the SRR cost.

What would trigger a change in the Base Rate?

The BR will be adjusted when there are changes in monetary policy eg: Overnight Policy Rate (OPR) and/ or changes in the benchmark cost of fund i.e. average deposit rate.

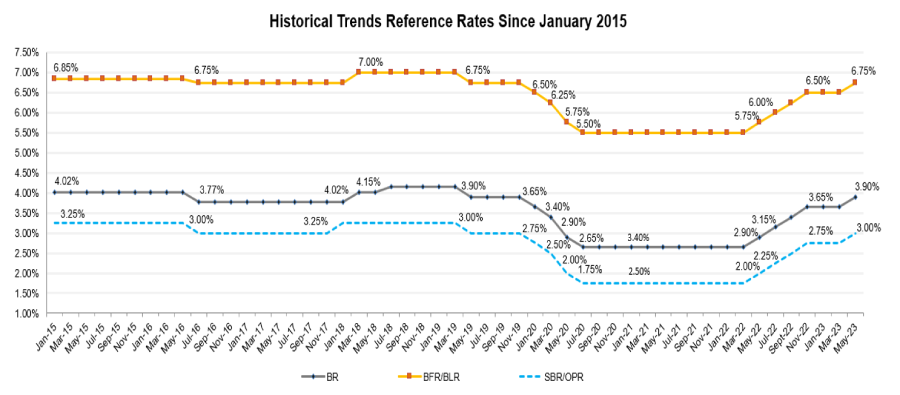

Historical Base Rate (BR), Base Financing Rate (BFR) and Standardised Base Rate (SBR)

Historical benchmark Cost of Fund (COF) in the last 3 years

Effective 12 May 2023 MBSB Bank Berhad’s Standardised Base Rate, Base Rate and Base Financing Rate will be changed, as follows:

| Rate Types | Current Rates (p.a) |

|---|---|

| Standardised Base Rate (SBR) | 3.00% |

| Base Rate (BR) | 3.90% |

| Base Financing Rate (BFR) | 6.75% |

Note: The Bank will be using the SBR for pricing new retail floating rate financing facilities including refinancing while the existing floating rate retail financing pegged against BR and BFR shall continue to be priced against BR and BFR until maturity.

For the purpose of disclosure requirement, our indicative effective financing rate for standard housing financing with financing amount of RM350,000 for 30 years with no lock-in period stands at 4.45%.

Thank You.

Document Download